Enterprise model of Skydio X10

Drone Trade Insights has revealed their newest report detailing the state of Drone Trade Investments. The analysis is an in-depth evaluation: however one stark reality stands out within the abstract. Within the realm of drone business funding, the 12 months 2023 witnessed a notable downturn, marking a departure from the meteoric rise seen in earlier years.

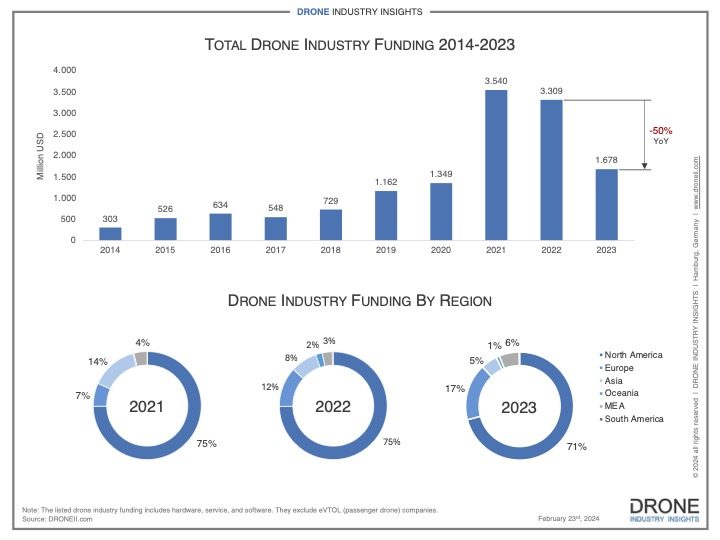

Knowledge gleaned from funding infographics and the weblog submit by Zahra Lotfi reveals that the cumulative whole of funding for drone corporations worldwide in 2023 stood at US$1.7 billion. Whereas this determine might seem substantial at first look, it pales compared to the earlier 12 months’s whole of US$3.3 billion, signifying a stark decline.

An evaluation of funding patterns sheds mild on a number of key elements contributing to this downturn. One vital side is the shifting panorama of enterprise capital investments, significantly in later-stage funding rounds. Throughout numerous industries, together with drones, there was a noticeable lower within the worth of such investments. This development means that corporations transitioning previous the startup part might encounter higher challenges in securing substantial monetary backing.

Furthermore, the panorama of preliminary public choices (IPOs) and post-IPO offers presents a combined image. Whereas the worth of those transactions has greater than doubled, indicating a constructive trajectory for corporations getting into monetary markets, there was a discount within the variety of such offers in comparison with the earlier 12 months. This dichotomy underscores the nuanced nature of the funding panorama, defying easy categorization as wholly constructive or unfavorable.

Regionally, North America emerged as the first beneficiary of drone firm funding, capturing 71% of the worldwide whole. Main investments in corporations like Zipline and Skydio bolstered the area’s place as a key participant within the business. Nonetheless, the share of funding allotted to North America has declined since 2021, whereas Europe has seen a gentle enhance, accounting for 17% of world funding in 2023.

The distribution of funding throughout business segments additionally provides insights into prevailing tendencies. {Hardware} corporations proceed to obtain the next proportion of investments, reflecting the numerous prices related to manufacturing drone platforms. However, there was a notable shift in funding in direction of drone service corporations, surpassing investments in drone software program corporations—a reversal from the earlier 12 months.

As stakeholders ponder the implications of those funding dynamics, questions come up concerning the trajectory of the drone business. Is the decline in funding indicative of a broader shift in direction of rising applied sciences equivalent to Superior Air Mobility (AAM)? Or does it signify a pure development because the business matures? With these issues in thoughts, stakeholders are poised to navigate the evolving panorama of drone business funding, adapting methods to capitalize on rising alternatives and deal with underlying challenges.

Regardless of the stark distinction in funding between 2022 and 2023, Lotfi sees room for optimism within the numbers:

“The financial shocks and main monetary impression of the COVID-19 pandemic in 2020-2021 led to astoundingly excessive investments in drone know-how (the place funding values greater than doubled). But when these outlier years are factored out, drone firm funding would nonetheless present a steady upward development since 2017,” she writes. “Furthermore, deep applied sciences equivalent to synthetic intelligence and machine studying are trending upward at an unbelievable fee, and these have a direct impression on drone know-how. Maybe these will even create a novel alternative to spend money on drone corporations very similar to the pandemic did, besides this time the regulatory progress will even be extra palpable.”

Miriam McNabb is the Editor-in-Chief of DRONELIFE and CEO of JobForDrones, an expert drone providers market, and a fascinated observer of the rising drone business and the regulatory surroundings for drones. Miriam has penned over 3,000 articles centered on the business drone house and is a world speaker and acknowledged determine within the business. Miriam has a level from the College of Chicago and over 20 years of expertise in excessive tech gross sales and advertising for brand spanking new applied sciences.

For drone business consulting or writing, Electronic mail Miriam.

TWITTER:@spaldingbarker

Subscribe to DroneLife right here.